Industrial: Breaking Down the Numbers

Last month, we published our 2nd Annual RCM-SIOR Industrial Investor Sentiment Report providing greater insights into the state of the industrial investment market and the issues/trends shaping this segment.

Conventional wisdom in the sector says there is plenty of runway left in what has been a very strong market for much of the last decade. As a follow up to the report, we’ve further broken down the numbers. Specifically, we looked at how investors’ take on the booming market impacted other viewpoints. More than 43 percent of investors (the bulls) believe activity levels will increase compared to 48 percent (the plateaus) who believe activity will remain essentially unchanged.

The breakdown provides interesting comparisons. In some cases, opinions differ, and in others, it is only the strength of the conviction that changed.

The Greatest Impact—The RCM-SIOR Report highlighted the overall strength of the economy and the growth and expansion of e-commerce as providing a powerful one-two punch. When breaking it down, the one-two punch remained, but in a different order.

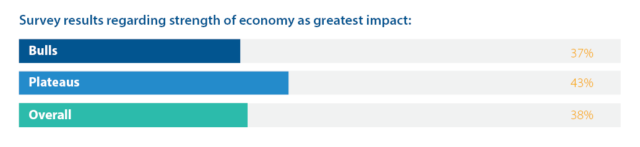

The bulls favored the growth of e-commerce over the strength of the economy as the greatest impact, while the plateaus believe the greatest impact is the strength of the economy, followed by the growth of e-commerce.

Agreement: Lack of quality assets a threat—The one area where these two audiences were aligned, was that regardless of where they think activity levels are going, they believe the greatest threat is the lack of quality assets for acquisition. That threat was selected by 38 percent of the bulls and 37 percent of the plateaus.

Interest rates are a chief concern—Investors across the board are watching the Fed’s moves on interest rates and waiting to see the impact it will have on the cost of funds. Of all participants, interest rates were viewed as the number one concern 35 percent. That number was significantly higher for the bulls—43 percent. The plateaus were equally as concerned with tariffs and trade wars as they were with interest rates (27 percent).

The last shall be first!—Universally, investors see last mile facilities as having the greatest opportunity for expansion. While more than half of all participants chose last mile over traditional manufacturing, multi-story warehouses and high-tech manufacturing facilities, the preference was stronger for the bulls (65 percent) than with the plateaus (42 percent).

Further, in the overall report findings, 65 percent of participants expect that pricing will increase, with more than 38 percent expressing an expectation that prices could rise by as much as 5 percent or more. Investors bullish on activity are even more likely to believe in an increase—almost half (49 percent) expecting price increases over five percent.

CLICK HERE TO VIEW THE COMPLETE REPORT.